| ||||||||||||||

September 19, 2024 | ||||||||||||||

Audience: Association Correspondents Please share the following information with your members. 새로운 지평 열기: 보험과 연금을 넘어서: 계리사들 FRTB(Fundamental Review of the Trading Book)는 2007~2009년 글로벌 금융위기 이후 BCBS(Basel Committee on Banking Supervision)에 도입되었으며, 거래 활동에 대한 시장 리스크 기반 자본 요구사항을 계산하는 방식으로 완전히 개편하는 것을 목표로 하고 있습니다. 이 웨비나는 두 개의 시리즈로 진행됩니다. 첫 번째는 은행에서 시장 리스크 관리 및 측정을 배우고, 계리사들이 어떻게 은행의 거래계좌에서 시장 리스크 측정을 지원할 수 있는지에 대한 기회를 제공합니다. 두번째는 Basel III FRTB 규정을 소개하고 FRTB 개혁안의 핵임 요소에 대한 개요를 제공합니다. 마지막으로, FRTB 표준 접근법에 따른 시장 리스크 자본 계산을 위한 가상의 케이스 스터디를 제시하며, 이는 FRTB 범위에 속하는 모든 은행에 적용되는 기본 시장 자본 요구 사항입니다.

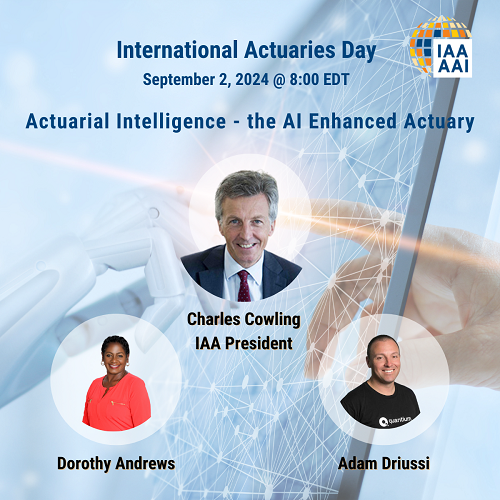

사전 이사회 웨비나 Audience: Council Delegates 탈린 사전 이사회가 오늘 열렸습니다. 참석하지 못하셨거나 동료와 공유하고 싶다면 녹화본과 자료를 이 링크에서 확인하실 수 있습니다.. Audience: Council Delegates 7월 9일, 8월 20일, 8월 30일 에 진행되었던 집행위원회 회의록이 온라인에 게시되었습니다.집행위원회는 탈린에서 차기 회의를 진행할 예정이며, 회의록은 회정 확정 후에 공개될 예정입니다. 문의사항이 있으신 경우 사무총장에게 연락주시기 바랍니다. 국제 보험계리사의 날: 인공지능으로 강화된 계리 능력 Audience: All

기후 리스크 웨비나: 사회보장에 대한 기후 관련 위험의 계리적 고려사항 Audience: All

International Actuarial Notes (IANs) Audience: All International Actuarial Notes (IANs) 웹페이지가 업데이트 되었으며, 보험 회계 위원회에서 검토 및 재발행한 IANs 104와 105로 연결되는 링크를 제공합니다. 콜롬비아 국제 심포지엄 Audience: All 콜롬비아 보험계리사회는 2024년 11월 13일부터 16일까지 보고타의 Casa Dann Carlton 호텔에서 개최는 제8회 국제 계리 심포지엄에 여러분을 초대합니다. 이 심포지엄에는 여러 지역의 저명한 보험계리사들이 참여하이 다양한 활동이 진행될 예정입니다. 이 행사는 스페인어로 진행되며, 자세한 내용은 다음 링크를 참고하시기 바랍니다. https://simposiointernacionalaca.com/

| ||||||||||||||

|

| ||||||||||||||

September 19, 2024 | ||||||||||||||

Banking Virtual Forum Webinars Audience: Association Correspondents Please share the following information with your members.

Pre-Council Webinar Audience: Council Delegates The Tallinn pre-Council webinar was held earlier today. If you were unable to attend the webinar, or wish to share with colleagues, you can access the recording and slides at these links. Executive Committee Report to Council Audience: Council Delegates The minutes from the Executive Committee on July 9, August 20 and August 30 are available online. The EC will meet next in Tallinn and those minutes will be made available once they are finalized. Should you have any questions or comments, please contact the Executive Director. International Actuaries Day: Actuarial Intelligence - The AI Enhanced Actuary Audience: All

Climate Risk Webinar: Actuarial Considerations Around Climate-Related Risks on Social Security Audience: All

International Actuarial Notes (IANs) Audience: All Please note that the Webpage for International Actuarial Notes (IANs) has been updated and now provides links to IANs 104 and 105 reviewed and re-published by the Insurance Accounting Committee. International Symposium in Colombia Audience: All The Asociación Colombiana de Actuarios invites you to participate in its VIII Simposio Internacional de Actuaría that will take place at the Hotel Casa Dann Carlton in Bogotá, Colombia. The symposium will host activities from November 13th to the 16th and includes the participation of a number of renown actuaries from the region and will host a series of activities. For more information about this event that will take place in Spanish, please visit https://simposiointernacionalaca.com/

| ||||||||||||||

|